Development of core banking systems in Switzerland

The latest publication of the Core Banking Radar presents the characteristics of the established core banking systems in Switzerland and their developments in the last and next few years.

This is an excerpt from the full article.

In 2017/2018, the Core Banking Radar examined the eight most relevant core banking systems for Switzerland using a comprehensive methodology. In 2022/2023, the interviews with representatives of these established systems in Switzerland were repeated in order to find out how the systems have developed.

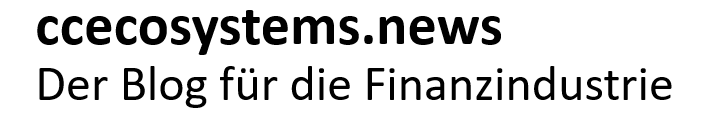

Over the last five years, the systems focused their developments on the following specific topics (sorted by number of mentions among the core banking systems):

- SaaS (Software as a Service)

- Customer Behaviour Analysis / Data Science / 360-Degree Customer View

- Consulting

- Open API interfaces / open platform

- Digital assets / cryptos

- Instant payments (services)

Core banking systems have been engaged in four overarching activities in recent years:

- Gradual renewal of infrastructure and increase in cloud capability

While the usefulness of the cloud installations used to be questioned, the core banking system providers are now systematically working on supporting new infrastructure including cloud capability. - Optimisation of the system with selected innovations

The functional scope of the core banking systems has hardly changed. We are dealing with mature systems and an already comprehensive range of functions. All systems focus on optimisation, as evidenced by selected innovations aimed at improving and enhancing the security of ongoing operations (for example, to meet regulatory requirements in the area of execution and settlement or to increase traceability in the management, monitoring and exceptions of transactions). Only a few systems enter new areas, such as function extension to include insurance services. - Partnering and building a partner ecosystem for specific additional services

Architecturally, the systems focus on opening up, reflecting the non-functional architecture category. Opening up is essential when it comes to covering the specific additional services in the ecosystem. The understanding of the ecosystem has changed, for many providers coverage in the ecosystem category was already high in 2018, but at that time it was still very much focused on collaboration with suppliers, whereas today the term also includes customers, other partners and their environment to cover the Customer Journey. - Complementing specific services such as instant payments or digital assets

Complementing specific services such as crypto assets and instant payments uses a wide range of functionalities, which increases the coverage of different functionalities overall.

According to the interviews, the focus of the providers on renewing the infrastructure, stabilising, partnering and supplementing specific services can also be expected to continue over the next few years.

Functionally, the systems are already so far advanced that there will be little focus on introducing new functionalities in the future. Of course, new regulatory requirements will be implemented, such as Instant Payment and the Swiss Data Protection Act. New functionalities being developed are hybrid advisory and portfolio risk management. Some schemes also aim to introduce further web-based front-ends (consulting, pension, etc.).

The addition of specific services will continue to be a focus in the future; digital currencies in particular continue to be among those areas of development explicitly mentioned.

In the non-functional area of architecture, the core banking system providers are talking about investing in new infrastructure support, cloud capability, SaaS and BaaS as well as opening up via Open API in the next few years. In the coming years, the provision of embedded finance will also be a topic for some systems.

Microservices are on the roadmap for many providers, highlighting the focus on infrastructure renewal.

In the area of operability, the planned increase in the degree of automation as well as the reduction of downtime pay into the renewal and stabilisation account.

All manufacturers are concerned with opening up their own systems. This therefore entails weighing or combining the following options:

Stage 1: Individual integration: Positioning as a provider without an integration platform that nevertheless coordinates API providers and consumers (fintechs and banks) and provides its own APIs for integrating into other platforms (BaaS services).

Stage 2: Integration platform: Offer a set of aggregated and combinable APIs on an integration platform (Finnova Open Platform or Swisscom Integration Layer).

Stage 3: API Marketplace: Provision of a platform or an API marketplace (via SIX bLink or Swisscom Open Business Hub, for example) where third-party providers can also place their services.

How the core banking market in Switzerland continues to develop will continue to be investigated and described by the Core Banking Radar. An overview of the characteristics of the established systems can be found in the detailed article.

The Core Banking Radar from the collaboration of Business Engineering Institute St. Gallen (BEI) and Swisscom has been analyzing the most common and emerging core banking systems in Switzerland at regular intervals since 2017 using a comprehensive assessment model.